In Alaska, specific challenges related to permafrost, seismic activity, and soil conditions add another layer of complexity. Permafrost can create difficulties in excavation and infrastructure stability, while seismic activity poses risks to both equipment and personnel. Soil conditions, including the presence of unstable or loose materials, can complicate mining operations.

To overcome these challenges, successful miners employ various mitigation strategies. For example, advanced geological surveys can identify potential hazards and guide the placement of infrastructure to avoid permafrost zones or areas prone to seismic activity. Innovative exploration techniques, such as remote sensing and geophysical surveys, help in accurately mapping gold deposits and assessing the viability of mining sites.

Furthermore, a miner must take into consideration the depth of pay streaks or gold veins, and the geological hazards associated with mining in specific locations, such as canyons, hillsides, or pits. By employing these strategies, miners can maximize their chances of success and minimize the risks involved. Thorough preparation and the use of advanced techniques can help miners navigate these geological challenges successfully.

Regulatory Red Tape

Navigating the regulatory landscape is another significant challenge for prospective mine owners. Buying an existing gold mine means inheriting not only its assets but also its liabilities, including any regulatory violations or environmental concerns that may have accrued over the years. From permitting requirements to compliance with environmental regulations, ensuring that the mine is in good standing with regulatory authorities is essential to avoiding costly fines and penalties.

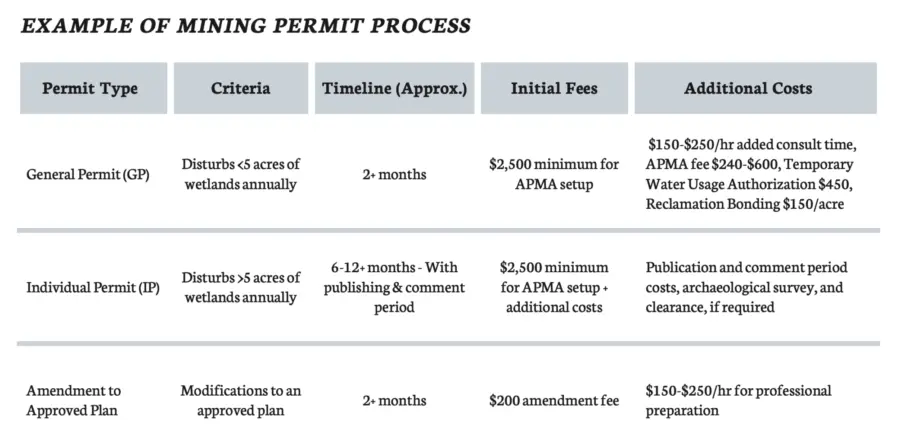

The regulatory environment in Alaska is particularly stringent, given the state's commitment to preserving its natural beauty and resources. This means that mining operations must adhere to a variety of state and federal regulations, overseen by agencies such as the Department of Natural Resources (DNR) and the Environmental Protection Agency (EPA). Permits are required for various aspects of mining, including land use, water usage, and waste management.

One of the key aspects of managing regulatory compliance is staying current with all required permits and renewals. This involves regular communication with regulatory bodies, submitting necessary documentation on time, and ensuring that all mining activities are conducted within the legal framework. Failing to comply with these regulations can result in severe penalties, including fines, suspension of operations, or even revocation of permits.